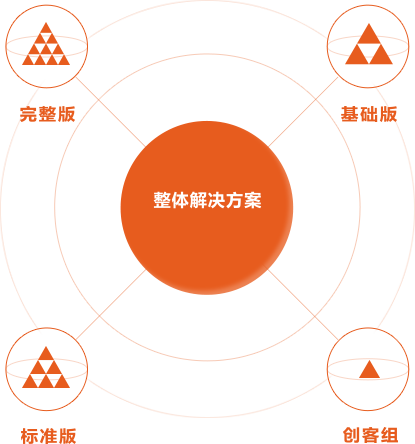

解决方案

Solution

学校

符合教育发展规划、促进素质教育实施、打造学校教育特色

教师

拓宽教育视野、了解前言教育理念、促进自身专业发展

学生

培养创新精神与创造力、提升学生素养、提升协作沟通能力、提升动手实践能力、提升解决问题能力

某某教育整体解决方案是基于中小学科学课程标准设计的十大主题课程为主体,利用独创的教学方式结合创客主题硬件实现可落地操作的创客教育,并配备:空间设计、数据实证系统、互动资源平台等,为学校提供更好的创客教育。